The ambit of the Employment Act 1955 (“EA 1955”) will change effective from 1.9.2022 pursuant to the Employment (Amendment of First Schedule) Order 2022 (“Amendment Order”), in conjunction with the Employment (Amendment) Act 2022 (“Amendment Act”).

Prior to the Amendment Order, the EA 1955 as it stands only applies to persons falling within the following categories:

- employees whose wages do not exceed RM2,000 per month; or

- being irrespective of the amount of wages, employees who are engaged in manual labour, supervision of employees engaged in manual labour, in the operation or maintenance of any mechanically propelled vehicle, in certain capacities in any vessel registered in Malaysia, and as domestic servants.

However, the Amendment Order has now expanded the EA 1955 to cover all employees. The EA 1955 now applies to:

- any person who has entered into a contract ofservice regardless of their salaries. However, the following provisions in the EA 1955 will not apply to employees who earn more than RM4,000 per month:

- section 60(3) – overtime for work on rest days;

- section 60A(3) – overtime for work in excess of the working hours;

- section 60C(2A) – allowance for shift work;

- section 60D(3) – overtime and allowance for work on public holidays;

- section 60D(4) – overtime for work on holidays on half working days;

- section 60J – termination, lay-off and retirement benefits.

In light of the above, it is important for employees and employers alike to be apprised of the amendments to the EA 1955. Some salient changes to the EA 1955 are as follows:

(1) More protection to female employees

- The paid maternity period has been increased from 60 days to 98 days.

- Where a female employee is pregnant or is suffering from an illness arising out of her pregnancy, her employment shall not be terminated except on such limited grounds as follows:

- wilful breach of a condition of the contract of service;

- misconduct;

- closure of the employer’s business.

(2) New benefit to male employees

A new section 60FA is introduced which provides that a married male employee shall be entitled to a paid paternity leave for a period of 7 consecutive days for each confinement, up to 5 confinements irrespective of the number of spouses.

In order to be entitled to the paternity leave, the employee must:

- have been employed by the same employer for at least 12 months immediately before the commencement of such paternity leave; and

- have notified his employer of the pregnancy of his spouse at least 30 days from the expected confinement or as early as possible after the birth.

(3) Sick leave and hospitalisation leave

Before the amendment, where no hospitalisation is necessary, an employee is entitled to paid sick leave ranging from 14 days to 21 days depending on their length of service with the employer. On the other hand, where hospitalisation is necessary, the employee is entitled to 60 days of paid sick leave provided that the total number of days of paid sick leave in a calendar year does not exceed 60 days in aggregate (in both cases of hospitalisation and non-hospitalisation).

However, the proviso has been removed and in effect, the employee will be entitled to paid sick leave of 14 to 21 days plus 60 days of hospitalisation leave.

(4) Flexible working arrangement

Subject to the contract of service, an employee may apply to his employer for a flexible working arrangement to vary the hours of work, days of work or place of work in relation to his employment. The application must be made in writing in the form and manner as determined by the Director General of Labour. At the time of writing, the prescribed form/manner of the application is not yet available.

The employer must also inform the employee in writing whether it would be approving or refusing the application within 60 days from the date of application. In the case of a refusal, the employer must state the ground of such refusal.

(5) Reduced weekly working hours

An employee must not be required to work more than 45 hours in one week. Previously, it was 48 hours.

(6) Presumption of employer-employee relationship unless proven to the contrary

In any proceeding for an offence under the EA 1955, in the absence of a written contract of service, a person shall be presumed to be an employee of another person:

- where his manner of work is subject to the control or direction of another person;

- where his hours of work are subject to the control or direction of another person;

- where he is provided with tools, materials or equipment by another person to execute work;

- where his work constitutes an integral part of another person’s business;

- where his work is performed solely for the benefit of another person; or

- where payment is made to him in return for work done by him at regular intervals and such payment constitutes the majority of his income.

(7) Discrimination in employment is punishable

A new provision is introduced which empowers the Director General to inquire into and decide any dispute between an employee and his employer in respect of any matter relating to discrimination in employment. The Director General may then, pursuant to such a decision make an order.

An employer who fails to comply with such an order commits an offence and is liable to a fine upon conviction.

However, the expression “discrimination” is not defined, and the provision also does not set out the types of orders that may be made by the Director General.

(8) Duty of employer to raise awareness on sexual harassment

A statutory obligation is imposed on an employer to, at all times, exhibit conspicuously at the place of employment, a notice to raise awareness on sexual harassment.

(9) Calculation of wages for incomplete month’s work

A new section 18A is added to introduce a formula for calculation of wages of an employee who is employed based on a monthly rate of pay and has not completed a whole month of service and whose circumstances fit any one of following categories:

- where he commenced employment after the first day of the month;

- where his employment was terminated before the end of the month;

- where he took leave of absence without pay for one or more days of the month; or

- where he took leave of absence by reason of having been called up for national service, to be present for national service training or to comply with any other written law relating to national service.

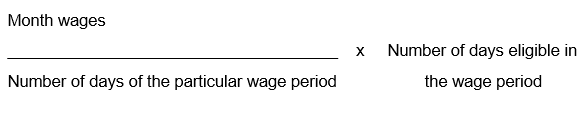

The said formula is as follows:

“The number of days of the particular wage period” is not defined in the EA 1955. There could be two (2) possible interpretations of this set phrase having considered the EA 1955 as a whole. Either:

- It should be read together with section 60I for a consistent and harmonious result. As a result of which it would refer to a period of 26 days pursuant to section 60I which provides that such a period should represent the number of working days in a month for calculation of the ordinary rate of pay under Part IX (maternity allowance) and Part XII (rest days, hours of work, holidays and other conditions of service); or,

- It refers to the number of days of the particular month in which the employee does not complete because:

- a wage period is defined as the period in respect of which wages earned by an employee are payable which shall not exceed one month;

- the opening words of section 18A which reads “notwithstanding Section 60I” suggest that it is not subject to the number of 26 days provided therein; and,

- if it is intended to be 26 days, it would have been provided as such, for instance section 60I.

(10) Prohibition of forced labour

It is now a statutory offence for any employer to threaten, deceive or force an employee to do any activity, service or work and prevent that employee from proceeding beyond the place or area where such activity, service or work is done. An employer who commits such an offence will be liable to a fine not exceeding RM100,000.00 or to imprisonment for a term not exceeding 2 years, or to both.

(11) Prior approval is required for employment of foreign employees

Prior to the Amendment Act, an employer is only required to furnish the Director General with the particulars of the foreign employee.

However, after the amendment, the employer must apply for an approval from the Director General before employing a foreign employee. The approval of such application is subject to the following conditions:

- the employer has no outstanding matter relating to any decision, order or directive issued under the EA 1955;

- the employer has no outstanding matter or case relating to any conviction for any offence under the EA 1955, the Employees’ Social Security Act 1969, the Employees’ Minimum Standards of Housing, Accommodations and Amenities Act 1990 or the National Wages Consultative Council Act 2011; or

- the employer has not been convicted of any offence under any written law in relation to anti-trafficking in persons and forced labour.

Comments

Previously, for employees who fall outside the scope of EA 1955, the terms of employment are subject to negotiations between the employer and employee except for some mandatory provisions, such as provisions in relation to maternity entitlements. In those days, the EA 1955 would serve as a guideline as to the minimum benefits to be provided by an employer to a non-EA employee.

However, with the amendments to EA 1955 and its First Schedule, the distinction between an EA-employee and non-EA employee has been abolished.

As such, it is particularly important for employers to revisit their employment contracts to ensure that they comply with the amended EA 1955. In any event, it is provided in section 7 of the EA 1955 that any term or condition of a contract of service which is less favourable than that prescribed in the Act shall be void to that extent and be substituted with the more favourable provisions of the Act.

For any enquiries, please contact the authors:

Gan Khong Aik

Partner

Gan Partnership

E: khongaik@ganlaw.my

Lee Sze Ching, Ashley

Senior Associate

Gan Partnership

E: szeching@ganlaw.my

DISCLAIMER: This article is for general information only and should not be relied upon as legal advice. The position stated herein is as at the date of publication on 24 August 2022. .